Everything about Appraisal On New Construction Home

Wiki Article

5 Simple Techniques For Appraisal On New Construction Home

Table of ContentsWhat Does Appraisal On New Construction Home Mean?Not known Factual Statements About Appraisal On New Construction Home Appraisal On New Construction Home Fundamentals Explained9 Simple Techniques For Appraisal On New Construction Home10 Easy Facts About Appraisal On New Construction Home Described

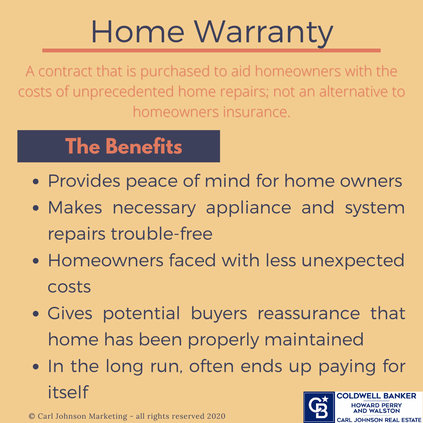

A home service warranty, additionally referred to as a residence security strategy, is a yearly solution contract that covers significant appliances as well as systems in your home when they damage down due to regular deterioration. This sort of defense from a top residence guarantee firm can conserve you from paying costly, out-of-pocket costs on repair work as well as replacements. This sort of residence protection plan will certainly provide assurance if a major residence item stops working and it will certainly avoid you from spending hours browsing for a relied on professional in your location to finish fixings. If you're acquiring a new building house, a home service warranty could not be necessary.

A supplier's warranty protects home appliances if they fail as a result of defective materials or malfunctioning workmanship. Maker's service warranties are typically only in result for a year or 2, as well as they don't cover systems and appliances that damage down due to regular wear as well as tear, so it may be an excellent idea to buy a residence guarantee once the supplier's service warranty runs out.

Appraisal On New Construction Home Fundamentals Explained

For example, the average expense to repair a water heating unit is $546. If you paid a $300 premium for your warranty and also a $100 solution cost for a hot water heater fixing, you would still have $146 that could be swiped for various other residence expenditures - appraisal on new construction home. Note: Most residence warranty plans consist of protection caps on different residence systems as well as appliances.

How Much Does a Home Guarantee Expense? Prior to you purchase a residence service warranty, think about the costs that come with these security plans.

The costs will certainly vary depending upon elements such as the level of coverage you enroll in as well as where you live. The price of a residence warranty standards in between $300 as well as $600 a year. The service charge is the fee you're charged when a solution technician concerns your residence to make a repair work or replacement after you sue.

Excitement About Appraisal On New Construction Home

The home inspection report might also show which appliances are nearing the end of their anticipated lives, so you can obtain a better concept of which things require the most protection. When coverage begins (generally after thirty days of signing a contract) and also a covered thing quits functioning, you would call the home service warranty firm to sue or send a claim online (appraisal on new construction home).All of these are superb perks that several other home warranty firms do not supply. The Equipments Strategy begins at $27. 99 per month as well as protects many major house devices like refrigerators and dishwashing machines. The Built-in Solutions Strategy starts at $32. 99 each month, as well as it covers major home systems like your electrical and pipes systems.

99 monthly. This strategy adds whatever covered in the Equipments Plan and Built-in Systems prepare together, as well as it additionally consists of a house owners insurance deductible reimbursement. This means Cinch provides you approximately $500 when you pay a deductible on a homeowners insurance policy case. The benefit is supplied as soon as per year.

It needs to be noted that cap restrictions special info use.: To share feedback or ask a question about this post, send out a note to our Reviews Team at.

An Unbiased View of Appraisal On New Construction Home

"Nevertheless, the much more systems you include, such as pool coverage or an added heating unit, the higher the price," she claims. Includes Meenan: "Rates are commonly negotiable also." Apart from the yearly cost, homeowners can anticipate to pay typically $100 to $200 per service call browse through, depending on the type of contract you purchase, Zwicker notes.Residence guarantees don't cover "items like pre-existing conditions, animal infestations, or remembered items, discusses Larson. This is the moment to take a close check out your protection since "the exemptions differ from program to program," states Mennan."If people do not read or understand the insurance coverages, they might end up thinking they have coverage for something they do not."Testimonial coverages as well as exclusions throughout the "totally free appearance" period.

"We paid $500 to sign up, and after that had to pay one more $300 to clean the major drain line after a shower drain back-up," says the Sanchezes. With $800 out of pocket, they believed: "We didn't profit from the home service discover this warranty in any way." As a young pair in an additional house, the Sanchezes had a difficult experience with a home guarantee.

When the technician had not been satisfied with a reading he got while testing the heating system, they claim, the company would not accept insurance coverage unless they paid to replace a $400 part, which they did. While this was the Sanchezes experience years earlier, Brown confirmed that "examining every significant home appliance before offering protection is not an industry standard."Always ask your service provider for quality.

Appraisal On New Construction Home - An Overview

If you're a home owner, after that possibilities are that at some point in time you have actually thought about obtaining a residence warranty. It's an insurance coverage strategy that uses security for your house versus unforeseen damages or malfunctions. There are lots of benefits to having a house warranty so keep reading to find out about the primary ones.

A house guarantee offers coverage for the complying with devices, consisting of however not limited to: air conditioner furnace refrigerator oven range as well as microwave ovens. When you obtain a residence warranty, you can relax assured that all significant residence systems are covered must they break down all of a sudden.

Secures you from the expense of unanticipated repair work A great deal of repair services around your residence can cost a great deal, yet with a home service warranty, you're secured from paying for these prices. House warranties can cover interior and outside home repairs. This indicates residence guarantees can cover residence devices, plumbing leaks, electrical problems, and also heating system repairs.

Some of them cover devices and also fixtures, which can be pricey to change ought to they damage. The comfort you'll have from a house service warranty permits you to check this site out go about living life without fretting so a lot if something happens to your home or requires immediate interest from a specialist.

Report this wiki page